Not long ago, a client emailed me asking if we had any exposure to business development companies (BDCs) in his portfolio. He was asking because he clearly noticed media headlines about steep declines in software stocks and BDCs. The catalyst was the theory that AI is going to displace the need for...

As we move into 2026, the most important objective is not making bold predictions—it is building portfolios that can endure a range of outcomes while still pursuing your long-term goals. As opposed to most firms, the framework we work with here is straightforward: avoid unnecessary knee-jerk reactio...

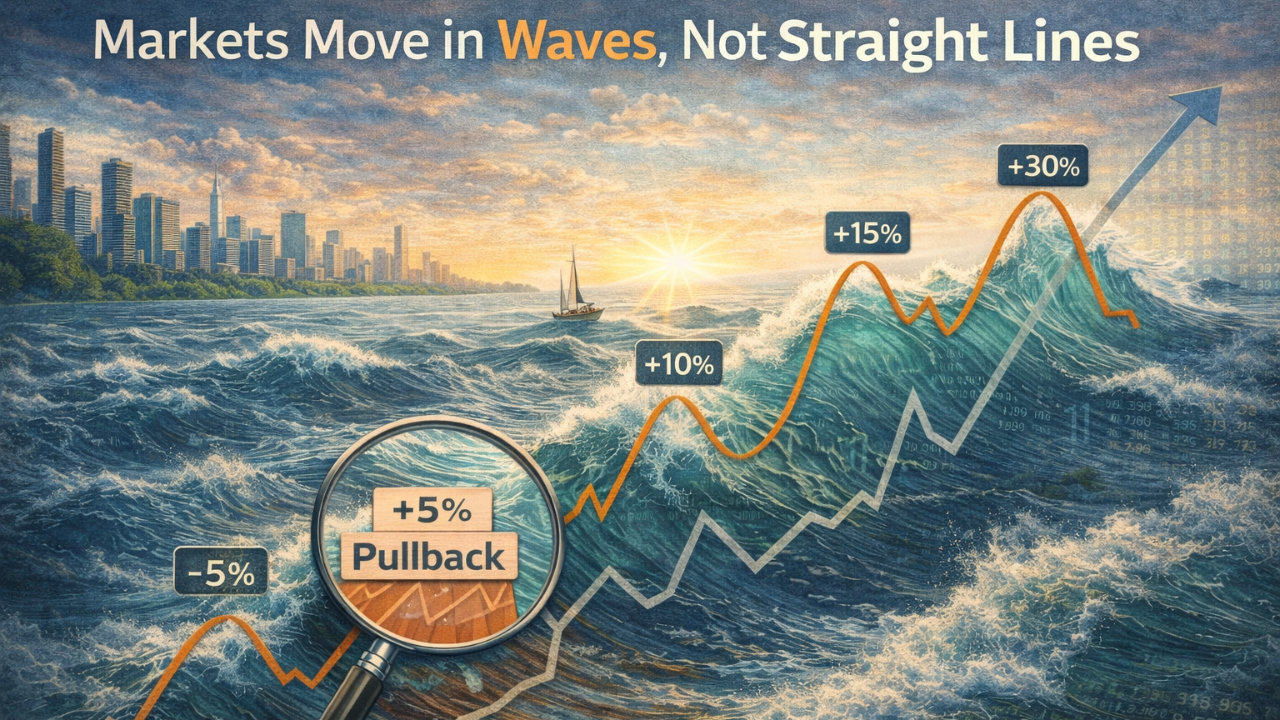

From an investment perspective, 2025 was a constructive year, even if it didn’t always feel that way in real time. Markets absorbed shifting expectations for inflation and interest rates, policy uncertainty, and periodic risk-off episodes, yet ended the year with broad gains across equities and a w...

Most investors want the same thing: stock market upside without stomach-churning downside.

Structured notes are hybrid investments that combine market exposure with an options strategy to create a more controlled mix of risk and return than owning stocks outright. They can be an effective way for r...

Over the past few days, you’ve likely seen headlines about the stock market “sliding,” “selling off,” or “pricing in an AI bubble.” Major U.S. indexes have pulled back a few percent from recent highs, and day-to-day swings have picked up again. As of this week, the S&P 500 is down a little 5% from i...

Client Memo: Is it 1999 All Over Again?

Many of us can recall the absolute euphoria that occurred in the mid-to-late 1990s. Companies with a “.com” at the end saw crazy volatility, mostly to the upside until the turn of the century before most of them went bankrupt.

Today, the debate is simil...

In our previous memo What the Genius Act means for Investors we detailed the recently passed Genius Act, which gives cryptocurrency a regulatory backdrop. The largest ramifications of this legislation is that it enables the web3 economy – i.e. facilitating a completely digital transaction without...

Long story short: The recently passed Genius Act establishes a regulatory framework around stablecoins, which use cryptocurrencies. The real impact is it legitimizes cryptocurrencies and effectively initializes the web3 economy. The web3 economy is a decentralized blockchain-powered internet that ...

The "One Big Beautiful Bill Act," signed into law on July 4, 2025, is a sweeping, nearly 900-page budget reconciliation and tax package. It extends major tax cuts, restructures elements of federal spending, overhauls regulations, and introduces new incentives—making it one of the most consequential ...

"Your Home Is Your Biggest Asset"... Or Is It?

Real estate has become a quasi-obsession in the United States, especially after some significant drawdowns in the stock market. The truth is that real estate is a poor investment for most investors.

You hear a lot that your home is your largest as...

Retirees hate to spend money in retirement. It’s not a big revelation as we are told for two decades during our childhoods and then are taught for decades working to only spend what you make and save the rest.

Dipping into savings is inculcated into us, almost from birth, as a bad thing. This ...

Real risk is simple—not enough cash when money is really needed—like running out of gas in the desert.

- Charles Ellis

We face countless risks in our everyday lives that we’ve learned, from a very young age, to manage. Managing those day-to-day risks may seem like second nature to most by ...