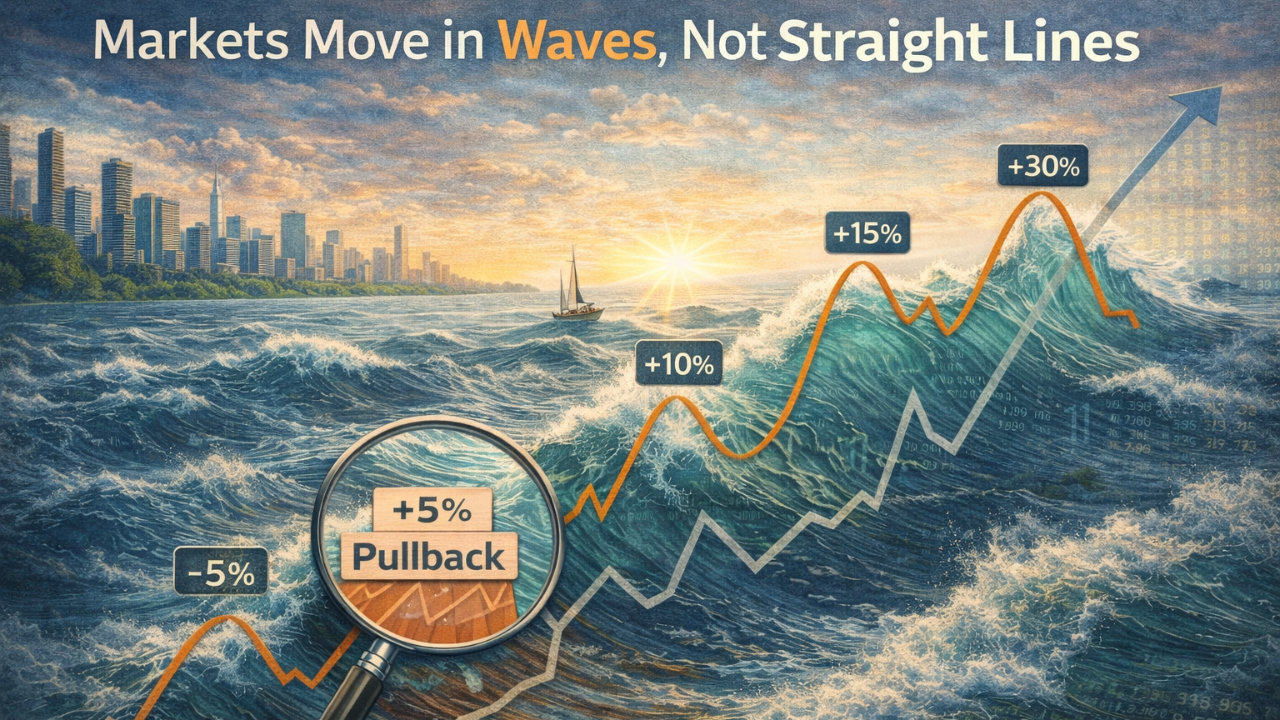

Over the past few days, you’ve likely seen headlines about the stock market “sliding,” “selling off,” or “pricing in an AI bubble.” Major U.S. indexes have pulled back a few percent from recent highs, and day-to-day swings have picked up again. As of this week, the S&P 500 is down a little 5% from i...

Long story short: The recently passed Genius Act establishes a regulatory framework around stablecoins, which use cryptocurrencies. The real impact is it legitimizes cryptocurrencies and effectively initializes the web3 economy. The web3 economy is a decentralized blockchain-powered internet that ...

The "One Big Beautiful Bill Act," signed into law on July 4, 2025, is a sweeping, nearly 900-page budget reconciliation and tax package. It extends major tax cuts, restructures elements of federal spending, overhauls regulations, and introduces new incentives—making it one of the most consequential ...

Why is speculation a game you cannot win?

Near my house there’s a mountain called Lone Peak with a trail called Jacobs ladder that goes nearly straight up. The cool thing about it is the end is always in sight. Just 6 miles ahead and about 4,000 feet up.

Upon nearing the top, you can see the exc...

At the start of 2020, markets were at all-time highs and, to borrow a phrase from the LEGO Movie’s annoying song, “everything was awesome.” At the time, there were only faint news reports of an outbreak in China causing a stir. And then, as these things tend to go, it was everywhere -all at once.

B...

President Trump recently unveiled a sweeping set of tariffs on exports from dozens of countries into the United States. Tariffs are duties imposed on imported goods by a government. They are intended to protect domestic industries, encourage local production, and generate tax revenue. In fact, tarif...

Tariffs are taxes levied by governments on imported goods. They aim to raise revenue, protect domestic industries, correct a trade deficit, impose political pressure on other states or deliver a combination of these goals. - Investopedia

With the new administration, there will always be uncertain...

I’ve been on this bandwagon for some time now but as the market zooms, we have to wonder what future returns will look like. The S&P 500 is on pace for its second straight 20%+ annual return. This has only occurred five times over the last 75 years, per Bloomberg.

20%+ returns in the market in a...

As we approach the upcoming presidential election, I want to address any concerns you may have about its potential impact on your investments.

I’ve received several emails asking what we are doing ahead of the November 5th election. The answer is simple: NOTHING!

There is a general rule of thum...

A common question I receive is ‘what interest rate does the Federal Reserve Bank (“Fed”) control’ and ‘how does it affect me?’ Since I’ve received the question a few times, here’s a memo!

The Fed controls the very shortest maturity rate called the Federal Funds rate. It is the interest rate that ba...

The First Rate Cut Since 2020

The Fed cut the interest rate they control (called Federal Funds) for the first time since March 2020 – during the panic of Covid. They started with a larger half a point cut. That was the right call in my opinion as inflation is down to 2.6% year-over-year and unemplo...

The S&P 500 Index hit its last all-time high on July 16th at 5,669. Since then, the market (as of this writing) is down about 8%. However, some stocks, namely Mega cap tech stocks, are down far more. The SPDR Technology Index ETF (XLK) is down 16% since its July 10th high.

What is driving this mo...