Near-Term Tariff Uncertainty Driving Volatility and Fear

Mar 03, 2025Tariffs are taxes levied by governments on imported goods. They aim to raise revenue, protect domestic industries, correct a trade deficit, impose political pressure on other states or deliver a combination of these goals. - Investopedia

With the new administration, there will always be uncertainty. With President Trump, there tends to be more uncertainty than is traditional. The Trump administration headlines are coming out minute by minute and have the ability to really change market direction and sentiment.

The ongoing tariff negotiations are the primary cause of this uncertainty. Trade is a large issue with the new administration and their America First policy directive.

In 2024, the US trade deficit grew by $133.5B (+17%) to a total of $918.4B. A lot of that increase was in the last two months of the year with a 25% growth rate in December alone, the largest monthly increase since 2015.

A lot of this is front-running the anticipation of tariffs in the near future. In other words, companies import goods from countries that are the focus of tariffs now in case the tariffs are implemented down the road.

The real question is, what is the long-term impact of a trade war? In 2018-2019, we had Trade War 1.0 during the first Trump administration. It can provide some key insights into this, Trade War 2.0.

For one, this trade war is broader encompassing both Mexico and Canada as well as China. This is because, in response to the first, many companies rejigged their supply chains to move production elsewhere including a lot going from China to Mexico. Mexico is now our second largest trade deficit country at $176B per year.

Early in January, the Trump administration said it would delay the implementation of these tariffs, and the market quickly recovered losses that it had experienced in the few weeks prior. However, Trump recently said tariffs will go into effect shortly and is going to start at 25% for both Canada and Mexico, excluding Canadian energy exports, and 20% for China.

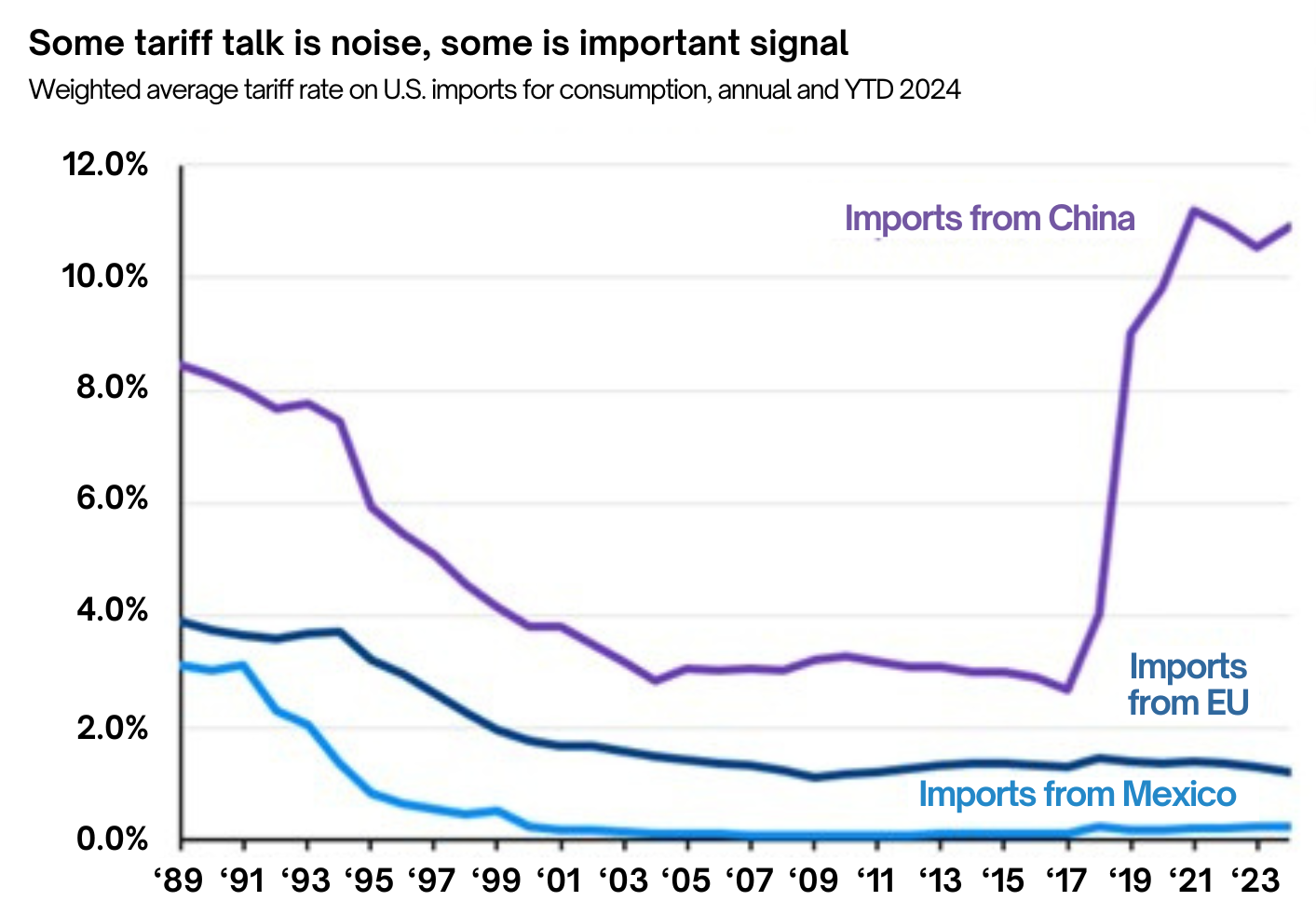

The chart below shows the average tariff rate on China, Mexico, and the EU. You can see that the last time around, the noise regarding tariffs on the EU and Mexico were mostly bluster and didn’t amount to much. On China, they have been sustained even after Trump left office by the Biden administration.

Source: U.S. International Trade Commission, J.P. Morgan Asset Management. EU is based on current membership.

The market is now coming to the realization that tariffs could in fact be a reality but not just on China this time, but on Canada and Mexico as well.

The actual ramifications of such a thing are not all that consequential. In fact, Goldman Sachs put out a long research note covering the economic implementation of these tariffs by the new administration. They state in summary:

We estimate that the net effect of these new tariff packages strictly through these production-side channels is a modest -0.2% drag on US industrial output or -0.04% on GDP.

We are talking about a fraction of a percentage on GDP. Basically, the country buying a pack of gum. Granted, certain industries may be more effected than others.

However, it is all about sentiment and the sentiment is shifting towards greater uncertainty and volatility. The long-term ramifications of this tariff war are likely to be minimal, similar to the last time this occurred during Trump 1.0.

More importantly, and starkly different from last time (2018-2019), equity valuations are very stretched. We discussed this recently in our First Quarter Client Commentary where we noted that future returns based on this valuation level would be very low.

This is why we have been shifting portfolios towards bonds which offer a relatively better value especially compared to the risk assumed. Interest rates have ceased rising and are providing a lot of ballast to portfolios along with juicy income streams.

We are also shifting towards greater use of buffer ETFs and structured notes where we are protecting downside risk on our equity positions. We will continue to move more capital into these as they make sense and to where they will make a meaningful impact on client accounts when the markets move decidedly lower.

The news cycle is on overdrive right now, so it is helpful to take a moment to take a deep breath. The challenges feel overwhelming, but they are not all that bad. We have navigated far more stormy waters in the past. It has just been so long that it feels like the world is ending. While valuations remain stretch, if we see a more meaningful sell off, we may become net buyers of stocks, though admittingly we have some distance until that would occur.

As always, we appreciate the trust you place in us and are here with any questions or concerns you may have.

Sincerely,

Mark J Asaro, CFA