Client Memo: Another Good Year In The Stock Market

Feb 10, 2025The market boomed again in 2024 for the second year in a row. 2022 seems like ages ago, the last bad year for the markets. I wrote then about how bad it was in aggregate because 2022 was the first year that both stocks and bonds were down double-digits (typically bonds rise when stocks fall).

In 2022, the S&P 500 was down 18.2% and the bond market (US Aggregate Bond Index) was down 13.0%. The combination of which felt like the end of the world to many since most investors have a split between stocks and bonds. And typically, when stocks fall by that amount, bonds rise in value offsetting some of the losses.

However, it now appears that 2022 was the outlier year. Here are the last six years of S&P 500 returns according to yCharts.

- 2019: +31.2%

- 2020: +18.0%

- 2021: +28.5%

- 2022: -18.2%

- 2023: +26.2%

- 2024: +24.29%

With the decade now half over– time flies, eh?– the Roaring Twenties has been a good decade so far, as the moniker suggests. So far in just the 2020s alone, the S&P is up approximately 100%. But it hasn’t been a straight line getting there. We had big moves lower in 2020 and 2022 that were significant (-33.9% and -25.4%, respectively).

While 2018 was only a small down year (-5%) there was a -20% drawdown that year too. But in 2017, the return was also remarkable at +22%.

No years in the last 8 have been “normal” at or near that +9.5% return typically associated as the long-term average return for US large cap stocks. Volatility is often associated with losses but it works in both directions. The 2020s have been filled with downside and upside volatility. Luckily, most of it has been to the upside as that’s the volatility we like.

We’ve actually had it made. Both the stock and bond side of portfolios have done fantastic lately. Good years in markets tend to follow other good years. But typically, not this good.

We are staring at back-to-back years of 25%+ returns. Since 1928 there have only been three other instances of 25%+ returns in back-to-back years:

- 1935 (+47%) and 1936 (+32%)

- 1954 (+53%) and 1955 (+33%)

- 1997 (+33%) and 1998 (+28%)

In those three instances, what happened next?

One year was awful (1937 at -35%), another year was great (+21% in 1999) and one was ‘just right’ (+7% in 1956), to use the Three Bears analogy. So, this isn’t very helpful for us to draw any conclusions.

As I wrote about a few months ago, valuations are near their highest levels ever (a la’ 1999). Are we setting ourselves up for a repeat of that time period with 20%+ returns for several years and then a ‘lost decade’ thereafter?

It’s certainly possible.

The bond market has been terrible the last few years. That’s because bonds are inversely correlated with interest rates and interest rates have been moving higher. In 2024 the Aggregate Bond Index was up just 1%. Over the last three years, you’ve lost a total of 5.3% and at one point the index was down nearly 18%.

There is no doubt that this is the worst bond market in history. All because the 30-year decline in interest rates finally hit their bottom during Covid and the massive amount of spending– and resulting inflation from it- forced the Federal Reserve to finally raise interest rates.

Thankfully, we have implemented the right strategies at Noble Wealth to not only avoid that decline but also produce nice upside returns as well. I would love to be able to insert each individual client’s bond returns here automatically but alas, we don’t have that capability.

Just note, with the right strategies in place utilizing individual bonds and closed-end bond funds as the centerpiece of the fixed income allocation, it would have been possible to see returns of 8-9% (before advisory fees) or greater. In other words, bonds (in the last two years if chosen correctly) would have been able to achieve the same long-term average of stocks.

I write this not to pat our team on the back but to acknowledge that we are doing what you pay us for – actually managing your money instead of babysitting it. We seek the best opportunities in the respective markets as we see them and do what is best for our clients, even if it is more work for us.

Going forward, I do think the bond market could outperform the equity markets, at least over the next several years. Valuations are extremely rich in stocks, but bonds are, from a relative standpoint, cheap.

Interest rates are set to come down so at Noble we’ve helped clients by buying individual bonds that allow them to lock in these current ‘elevated’ yields as compared to bond mutual funds which will see their yields drop when rates fall.

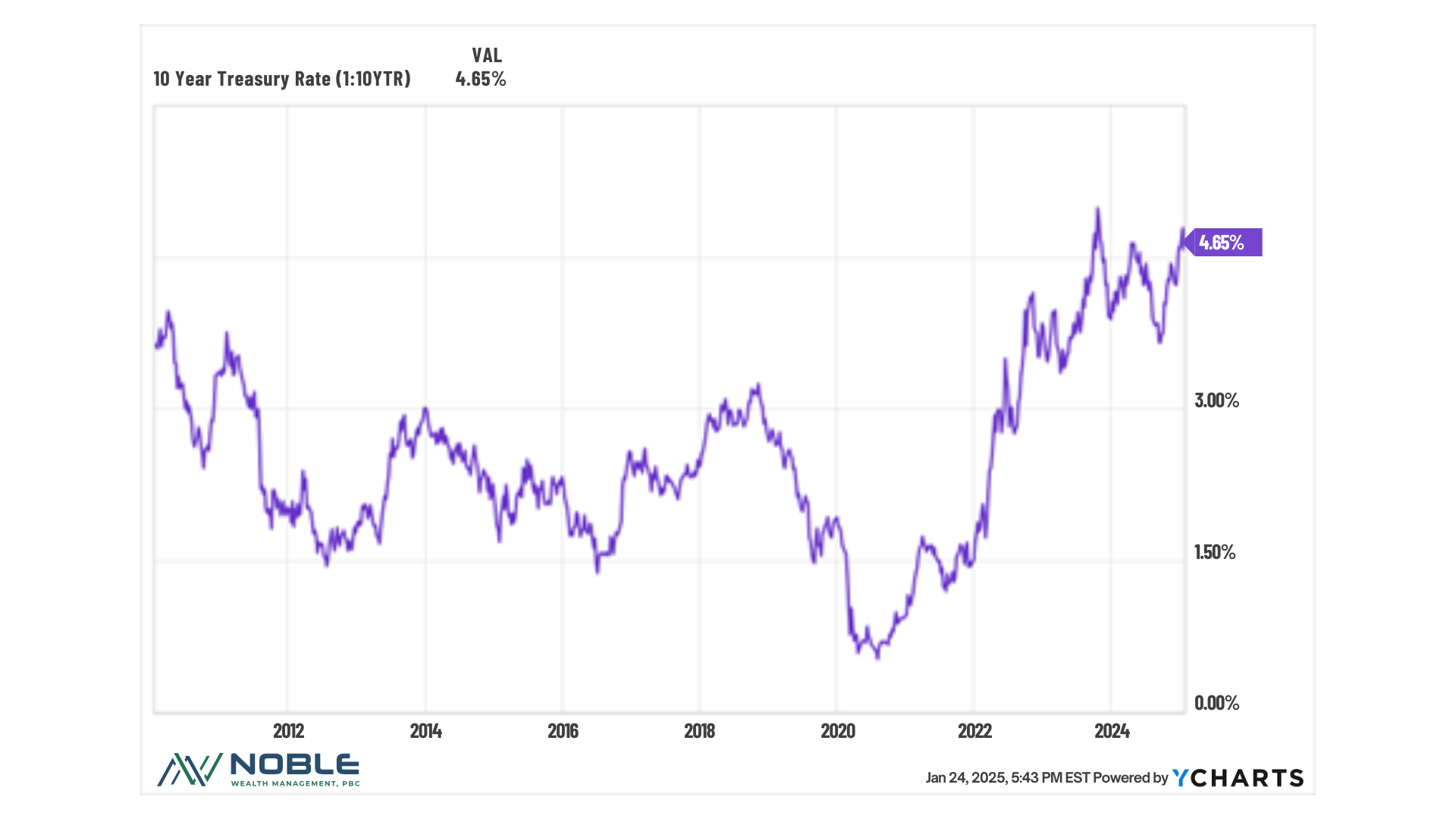

Yields were miniscule for most of the post-2008 period up until just a year or two ago. The chart below shows the 10-year treasury which meandered between 1.5% and 3.0% for most of the last 15 years until it recently moved as high as 5.0%.

What does the rest of 2025 hold or more importantly, the rest of the decade?

As I noted earlier, valuations are extremely rich. Statistically speaking, with a market that is trading at 22.5x the next twelve months’ earnings per share, the returns over the subsequent decade have not been good.

However, the theory is that AI and other productivity enhancements will drive massive growth once the capital expenditures have been made. I seem to recall the same kind of reasoning being used in the late 1990s as well.

I would caveat to that comment with some key differences this time around. For one, these companies are profitable unlike those internet company startups. Second, productivity enhancements are already appearing in many applications and industries. Profit margins are benefiting from significant efficiency gains aided by AI and other technologies that appear to be coming out faster and faster.

As we move through 2025, I will continue to stay vigilant on the markets. These valuations worry me and so I continue to believe in our strategy of focusing on fixed income for better risk-adjusted returns.

I also like the guardrails we are placing on portfolios using the Buffer ETFs and structured notes that we’ve discussed with you recently. These allow us to participate in the markets but also protect us from the downside.

I wrote an overview of these guardrails in a memo a couple of months ago titled, “Additional Ways to Reduce Risk and Protect Your Recent Gains”

If you have any questions or concerns, please DO NOT HESITATE to contact me or the team and we can set up a zoom call.

As always, we appreciate the trust and faith you have in us with your hard-earned capital.

Sincerely,

Mark J Asaro, CFA

Partner, CIO, Noble Wealth Management