Client Memo: There Are No Experts

Apr 14, 2025At the start of 2020, markets were at all-time highs and, to borrow a phrase from the LEGO Movie’s annoying song, “everything was awesome.” At the time, there were only faint news reports of an outbreak in China causing a stir. And then, as these things tend to go, it was everywhere -all at once.

By early March, the media was running report after report of new cases popping up in the U.S. Soon after, a “death count” ticker appeared on the lower right corner of some cable news outlets. Fear and hysteria started to grip the nation.

In mid-March, equity markets went into free fall as the economy began shutting down to “bend the curve.” No one knew anything, and suddenly, everyone was an expert on viruses.

I didn’t know what the future would bring either. Would we be forced to wear masks forever? Would schoolchildren learn from home indefinitely? Would offices and stores remain empty? No one could say they knew what was going to happen—and that included me.

The market fell 34.5% from its peak in just a month. Like a light switch flipping off, 11 million people were suddenly unemployed.

With the market not functioning properly due to a lack of buyers, I started buying for clients. At first, I just dipped in a pinky toe. I had no idea where the bottom was, and the volatility at that time was enormous. But as I gained confidence that a bottom might be approaching—and that Americans wouldn’t tolerate confinement for long—I began to invest more decisively.

People make decisions based on, in this order: (1) facts, (2) informed extrapolation or experience, and (3) speculation or opinion. During COVID, it was mostly No. 3—wild speculation—because no one had experience with a modern global pandemic.

But by keeping emotions in check (side note: my wife says I need to leave that “check” in the office and show more emotion at home) and thinking clearly about short-term scenarios, we were able to navigate that period with a relative degree of success.

In the Outlook I wrote back in January, I noted that the new administration brought a new level of uncertainty into the mix. Most would agree that Trump is not your typical president. He’s unpolished, with a sort of New York bravado that radiates more confidence than most.

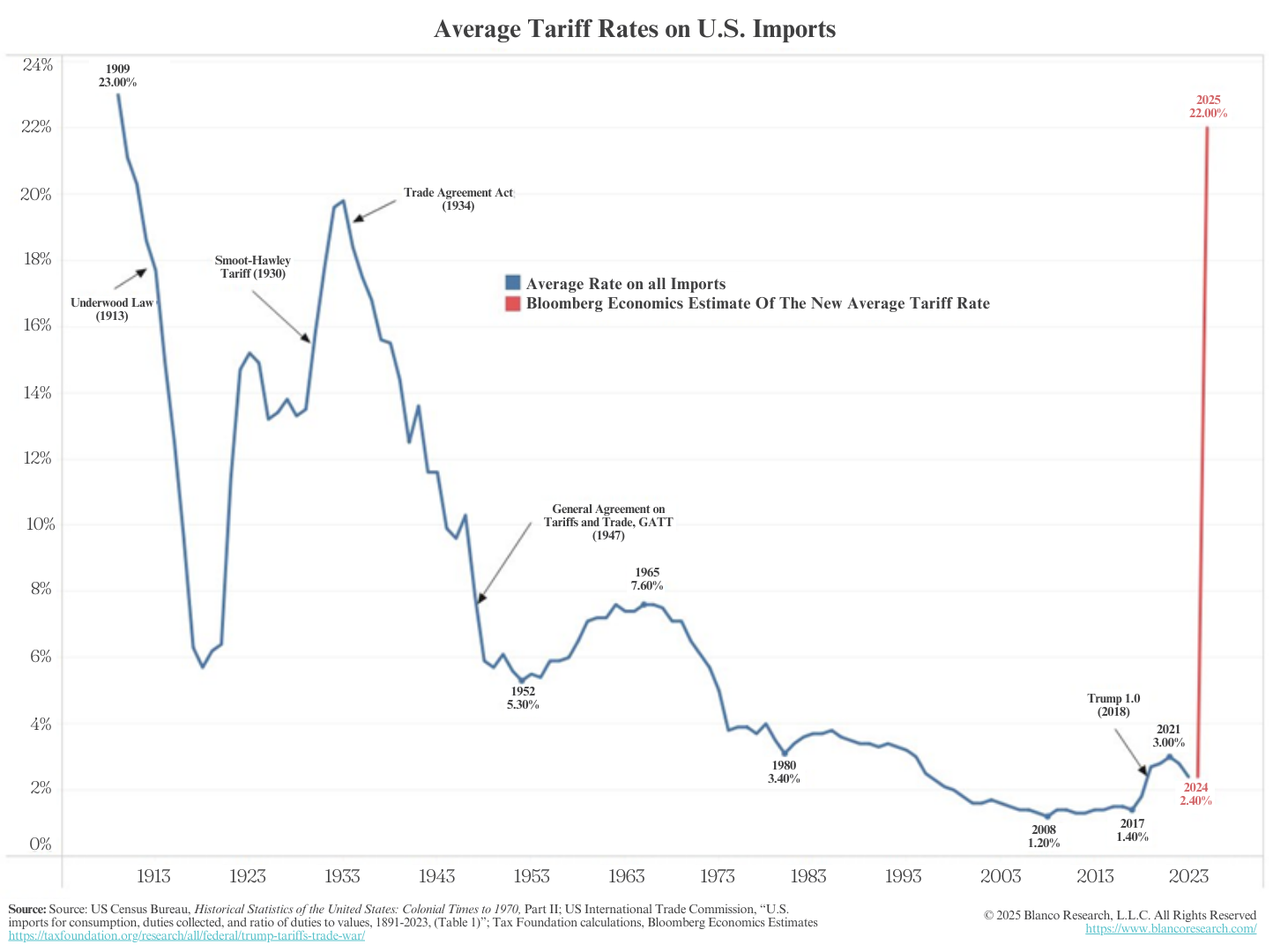

We knew from his campaign—and shortly after the election—that he would likely implement tariffs on imported goods. It was part of his populist strategy to pull working-class voters from the opposing party. It worked. (For context, he’s been advocating for tariffs since 1987. There’s a YouTube video where he supports them in an interview.)

Even though we expected tariffs, no one anticipated the magnitude. Clearly, the markets hadn’t. The actual tariff rates far exceeded even the highest forecasts.

Uncertain Uncertainty

Let me be clear: I have no idea what the future holds. My crystal ball is more like a Magic 8-Ball that leaked out its weird purple liquid. In periods like COVID—and now—I don’t reach conclusions with confidence. I act with trepidation.

Certainty in investing is like the word “guarantee” from a financial advisor—there’s no place for it, especially when markets are in upheaval.

I have no idea whether my actions will prove right, and I don’t judge them after a day or two. But if I can reason through what feels most logical and implement a plan based on that, then I can feel reasonably confident we’re heading in the right direction.

Sometimes, doing nothing is the best course of action. I’ve seen countless market pundits say just that over the past week. But “doing nothing” is still a decision. It’s a conscious choice to not react to the noise.

The most famous quote about buying low is attributed to Baron Rothschild: “When there’s blood in the streets, buy property.” But buying when everyone else is selling is one of the hardest things to do in investing. Surely all those sellers can’t be wrong... right?

In periods of sharp decline, it’s human nature to protect what’s left—to sell and preserve, not to double down. Yet, the best buying opportunities often show up in those exact moments—not when there’s sunshine, lollipops, unicorns, and everything is awesome.

One thing I often say: when it’s time to buy, you won’t want to.

What Changes Have We Made?

With the market down approximately 15% (as of this writing), we’ve begun dipping that pinky toe in again—buying securities we’ve had our eyes on for a long time. These are quality names that have been truly beaten up. Well, the prices have arrived.

Is it the bottom? I have no idea.

I’m just playing the regret minimization game. If I wait too long, I might miss the opportunity to buy risk assets at bargain prices. If I act too early, I risk doubling down ahead of more losses.

Investing is a game of not knowing. Anyone who goes on TV claiming to be an expert in predicting the future is, frankly, full of it. How can you analyze a future that hasn’t happened yet?

There are millions of variables, most of them unquantifiable— and constantly shifting. It reminds me of a video I watched in 6th-grade science class, showing atoms bouncing off each other, splitting, and triggering a chain reaction. For someone to say they know where every atom will go is just... silly.

All we can do is speculate—while managing risk.

How Do We Manage Risk?

We watch, we wait, and we pounce when we see a good deal.

For example, early in the bear market, safer assets were falling faster than riskier ones. That was because leveraged players were unwinding their positions by selling winners to raise cash. One of those assets was gold—traditionally a hedge against uncertainty. Yet it was being sold, not bought.

We bought into that gold decline. Since then, it’s been rebounding.

Another tool: structured notes, which we’ve discussed with you over the last nine months (view the November Commentary Slides here).

These notes price better when both volatility and interest rates are high—an uncommon combo. Usually, when volatility spikes, investors flee to U.S. Treasuries and rates fall. This time, both volatility and rates rose, making for ideal pricing.

Here’s one we purchased for clients:

A structured Principal Protection Note based on the S&P 500 and Nasdaq 100 futures. It offers 155% of the lesser-performing index’s upside over 5 years—with no downside risk from the purchase date.

Win-win.

Typically, structured notes come with 15% or 20% “hard” protection—meaning you’re shielded from the first 15% or 20% in losses. But this one gave us 100% protection. We will continue hunting for notes like this and integrating them into client portfolios.

Tariffs, Tweets, and What’s Next

No one knows how long these tariffs will remain. Some “experts” call them a negotiating tactic; others think they signal a shift back to a manufacturing-based economy. The main thing to take away is, there are no experts.

Given Trump’s ever-changing focus, everything is subject to change—at the whim of a tweet. It wouldn’t be shocking if he removed the tariffs tomorrow and declared victory, or if they stay in place for a year or more.

Since we don’t know, we’ll proceed cautiously—but remain opportunistic.

If tariffs stay, I believe a recession is a foregone conclusion. If they’re lifted, we could avoid one—and the market may rebound, like it did on April 9th.

Just remember there’s a timing mismatch between risks and rewards. Tariffs hurt immediately; any “wins” take months or years to show up.

We’ll continue to tread carefully and favor defensive positioning for now. But when rare opportunities arise—like the structured note example above—we’ll act.

As always, I’m here to talk about markets, portfolios, or why the Nuggets decided to fire their coach right before the playoffs.

Warmly,

Mark J. Asaro, CFA

DISCLOSURE: NOBLE WEALTH MANAGEMENT PBC is an SEC registered investment adviser. This is not an offer to buy or sell securities. No investment process is free of risk and there is no guarantee that the investment process described herein will be profitable. Investors may lose all of their investments. Past performance is not indicative of current or future performance and is not a guarantee. The information set forth herein was obtained from sources which we believe to be reliable, but we do not guarantee its accuracy. In preparing these materials, we have relied upon and assumed without independent verification, the accuracy and completeness of all information available from public and internal sources. NOBLE WEALTH MANAGEMENT PBC and NOBLE WEALTH MANAGEMENT PBCs shall not in any way be liable for claims and make no expressed or implied representations or warranties as to their accuracy or completeness or for statements or errors contained in or omissions from them. The performance information shown represents past performance and does not guarantee future results. The returns reflected may not be indicative of long-term performance.