Speculation is a Game You Cannot Win

Apr 21, 2025Why is speculation a game you cannot win?

Near my house there’s a mountain called Lone Peak with a trail called Jacobs ladder that goes nearly straight up. The cool thing about it is the end is always in sight. Just 6 miles ahead and about 4,000 feet up.

Upon nearing the top, you can see the excitement build in the hiking party since the finish line is right there – just a little farther. But once you reach the top, newcomers go from excitement to disappointment.

That’s because just beyond Lone Peak is Mount Baldy which is another couple thousand feet in elevation. Climbers thought they would be at the top but instead it was just an interim peak in the mountain range.

What’s the analogy?

In one of my prior memos, I asked “If Your Investments Made 14%, Would You Be Happy?” The answer was it depends. The response was in relation to how us human beings look at things on a relative basis, not an absolute one.

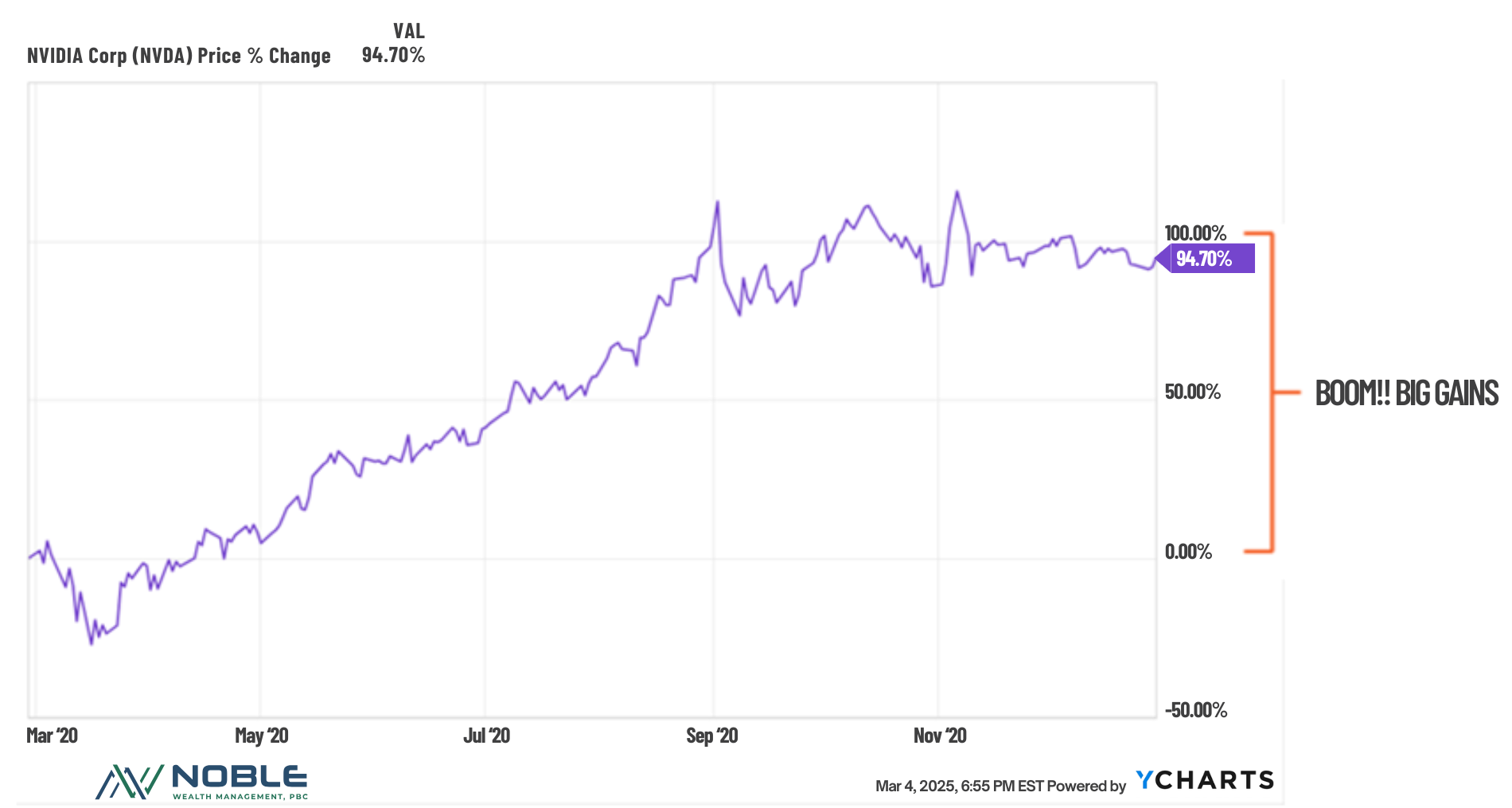

Let’s say, for instance, you bought 100 shares Nvidia stock in early 2020 at $270 per share ($6.75 split adjusted) for a total investment of $27,000. By the end of 2020, your stock was now $520 per share for a total return of 94%.

A 94% return- nearly a doubling of your money- in less than 9 months. You just hit a home run.

Didn’t you?

As an investor, we want to always buy at the most perfect time and sell at the most perfect time. Buying at or near the right time is hard enough but to do so and then be able to sell at the perfect moment is something out of a fairy tale.

After we sell, we want the stock to go down. We want to be proven right! We don’t want it to just go down. We want it to go to zero, or negative even!

The thing we often overlook is that if a stock is declining, someone is losing money. Thus, we are taking pleasure in someone else’s misfortune. Granted, that’s just the way the game is played. We cannot help that. It’s part of the process and we all certainly have bought loser stocks.

In the above scenario, you should be extremely happy. But what happened?

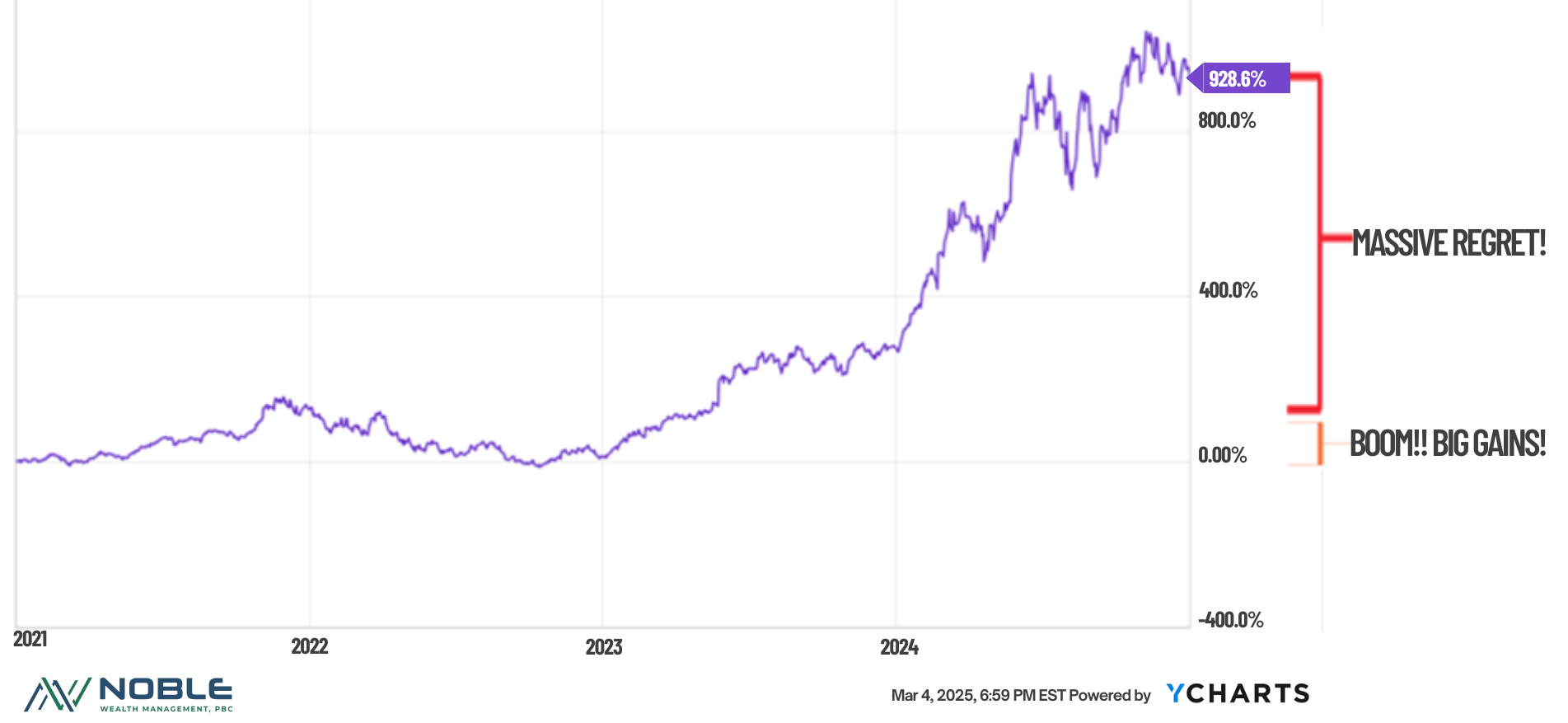

Over the course of the next three years, Nvidia soared. That 94% gain was just the tip of the iceberg to what happened over the next several years.

Nvidia was up another 800%+ over that time frame. Your $27,000 investment, which netted you a cool $25,400 profit, would have been worth more than half a million dollars ($537,000 to be specific).

Had the stock gone down after you sold it, you would be happy even though there is no monetary benefit to you. You being right is the trophy.

In both cases (the stock zoomed after you sold it or it tanked after selling it), you made the same amount of money. The 94%. In any light, that return is incredible. But to really win, we want to be right on both the buy and the sale.

This is why speculation is really a game you cannot win. Sure, you can “win” in terms of performance - exhibiting a strong return on your investments and being good at selecting new ones. In a sense, the regret of selling too early (or worse yet, selling too late and realizing a loss prior to which you had a nice gain) can be extremely burdensome and haunt you forever.

In another sense, having to actually root for the stock to decline after we sell it can leave you with a worse feeling inside.

Either way, it can take a mental toll on investors over time.

This is why, one, we invest on your behalf. There are a lot of non-quantitative benefits to having an advisor deal with the ups and downs and mental anguish involved in investing. This is a big one of them. Clients of advisors simply have to worry about the ‘big picture’, overall, what their accounts have done and how it relates to the financial goals.

Second, we take a long-term time horizon approach. We want to invest based on a minimum of one year and ideally, for multiple years. Market timing and quick moves in and out of investments are not a consideration. We allow consistency and compounding to do its thing.

Third, it is time. The time involved in finding investments, researching, tracking them, and then the resultant mental gymnastics involved when you inevitably sell too early or too late, missing out on potential gains, can be excessive. Time is the greatest of all assets and to spend it (some would say ‘waste it’) watching CNBC or mulling over ‘what might have been’ is a fruitless endeavor.

In the end it is about freeing your mind to focus on the things that are truly important and meaningful to you. Dwelling on the past or errors in a game that is unwinnable is something that can suck the life out of you and waste that time.

There are so many studies that focus on and attempt to quantify the cost of human behavior when it comes to investing. They call this the “Behavior Gap” or the difference between what the markets deliver, and the returns investors achieve for themselves.

In other words, creating a financial plan, portfolio, or investment strategy is not the major challenge for advisors. Rather, it can be making sure that clients adhere to the plan, especially during periods of volatility.

This is just another reason why we are here to help you.

Sincerely,

Mark J Asaro, CFA