Client Memo: If Your Investments Earned 14% Would You Be Happy?

Mar 28, 2025For one, our moods are often driven by relative, not absolute results. What I mean by that is, most people compare themselves to others or some benchmark to assess how they’ve done.

If I said to you that your portfolio made 14% last year, would you be happy? The answer is, “it depends.” What does it depend on?

If the S&P was up 25% and you were up 14%, then you may not be all that happy. It reminds me of when I was growing up and I would come home beaming with a 96% on my math test and my father’s response would be, “what happened to the other 4%?”

We focus on the relative potential, not the absolute result.

Of course, if the S&P happened to be down 10% and you were up 14%, you’d be ecstatic.

The former is what happened in 2024. The S&P 500 was an outlier returning 25% while most other areas of the public markets returned far less. That is because the S&P 500 was driven by a handful of stocks – Nvidia, Microsoft, Apple, Meta, Amazon, Google, and Tesla- who had very strong returns last year.

As shown below, you can see the return of the S&P along with the return of just those 7 stocks and the remaining 493. Without those 7 stocks, the S&P would have been up a more modest, but still good, 16%. In fact, one-quarter of that return was driven by just one stock alone- Nvidia. More than a third of the index was negative on the year.

Other areas of the market didn’t fare nearly as well. This means that if you build a diversified portfolio like we do, you likely underperformed.

However, since the media often reports on the S&P 500 over other areas of the market, we will undoubtedly get the question of “Why did we underperform so much?”

The reality is, we (advisors in general) didn’t.

A diversified portfolio means that a portion of your assets are in international stocks, emerging market stocks, real estate trusts, US mid cap stocks, and US small cap stocks.

The returns last year for those indices vary greatly.

- MSCI EAFE (international developed stocks): +3.8%

- MSCI Emerging Markets: +8.05%

- US Mid Caps: +13.9%

- US Small Caps: +8.6%

- Real estate (REITs): +4.8%

- Barclay’s Aggregate Bond: +1.3%

You can see no other area of global equities did anything even close to the S&P 500.

So why don’t we put all of our assets into the S&P 500?

Well, you could. But we won’t.

The S&P 500 is almost as overvalued today as it was in the late 1990s. The CAPE ratio, otherwise known as the Shiller P/E, is the price-to-earnings ratio of S&P 500 with the ‘e’ or earnings of the underlying companies, adjusted for the entire business cycle. It’s a long-term P/E that normalizes the earnings.

Today, that ratio is 36.4x, or about 4 points below the all-time high. The long-term average is just 16.5. The medium-term average (30 years) is about 18x. In either case, the market is more than twice as expensive as it has been.

Recently, Warren Buffett made headlines as his Berkshire Hathaway holding company reported a record cash pile of more than $325B. That is more than the stock positions owned which amount to $298B.

Why?

Buffett is a value investor and he currently sees no value in the markets – at least in US large cap stocks (where he has to focus on because of his size). Most of the cash came from selling shares of Apple which he bought more than ten years ago. When he started purchasing those shares, Apple traded at less than 10x earnings. Today, Apple trades at whopping 38x earnings – slower growing earnings on top of that!

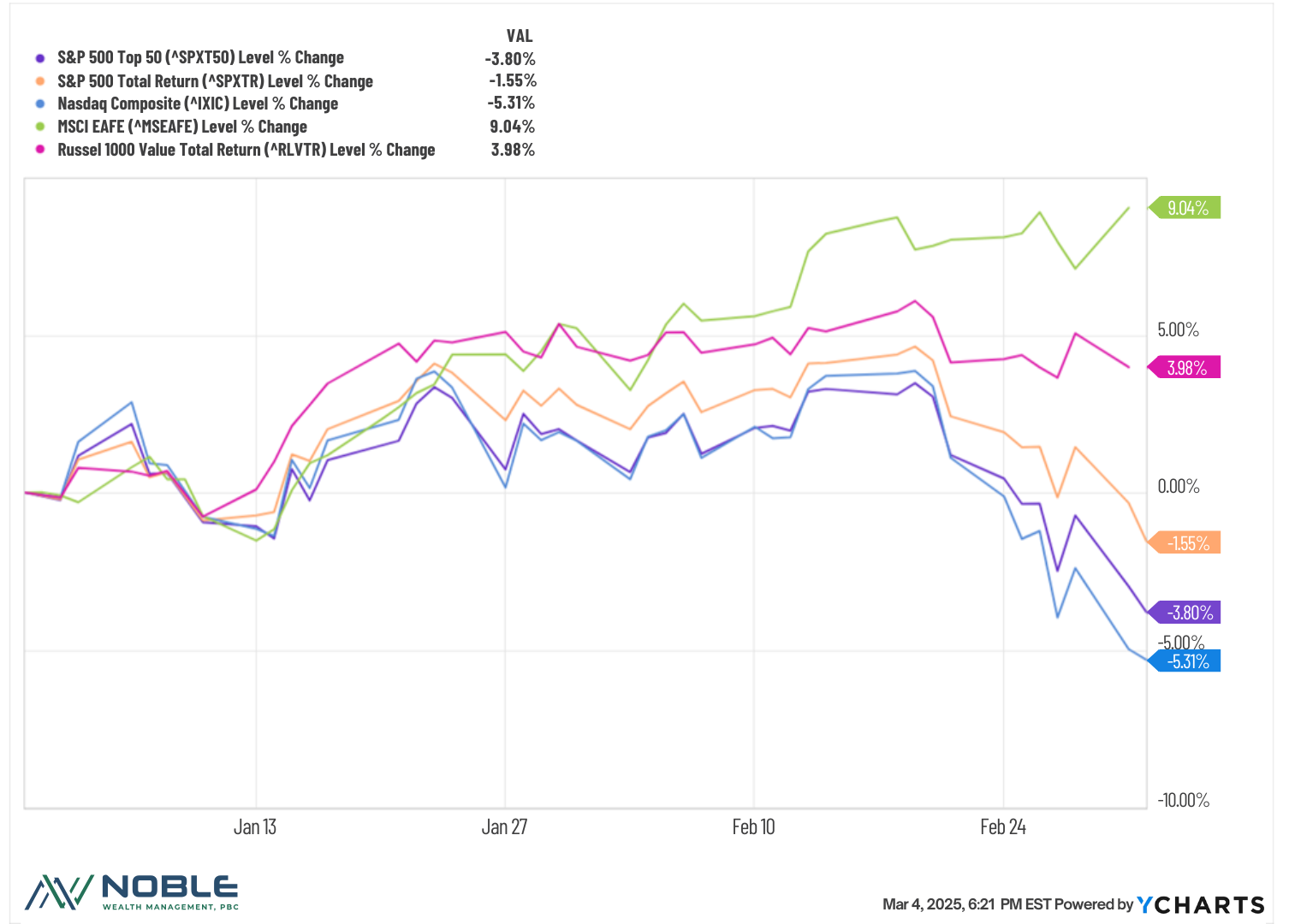

We are already seeing some leadership shifts in the market. International stocks (green line below) are besting US stocks (orange line) by a wide margin after just two months. Value stocks (pink line) are beating growth stocks handily.

Thankfully, we have reduced our exposure to the S&P 500 at just the right time (we discussed this back in our first quarter commentary webinar). We also have added to bonds and buffer ETFs to protect the gains we’ve made over the last few years.

Additionally, I started to add to international stocks late last year and again early this year in small increments. While I still overwhelmingly favor US stocks over any other region, the valuation differential is simply too massive to overlook, even with most of the innovation happening in this country.

We will continue to reduce risk where applicable and play offense and defense in these markets.

Speculation is a game we can’t win but we can reduce risk when we need to and move capital around to where it is best suited for each specific client based on risk. I’ll discuss more about speculation in my next memo.

As always, we appreciate the trust you place in us and are here with any questions or concerns you may have.

Sincerely,

Mark J Asaro, CFA