Client Memo: Is it 1999 All Over Again?

Sep 30, 2025Client Memo: Is it 1999 All Over Again?

Many of us can recall the absolute euphoria that occurred in the mid-to-late 1990s. Companies with a “.com” at the end saw crazy volatility, mostly to the upside until the turn of the century before most of them went bankrupt.

Today, the debate is similar although the circumstances are vastly different.

The AI debate centers around the amount of AI spending relative to the benefit to be realized down the road. The question many are asking is, what if there is no benefit?

Back in the late 1990s, there was a company called Global Crossing. Their business was focused on building the backbone of the internet. Essentially, they were a telecom company building a network of cables (buried in the ground and under the ocean) to make the internet global peer-to-peer networking.

At the end of the day, they went bankrupt (there may have also been an accounting scandal in the mix). At its height, it was valued at $47B (a lofty sum even today, but this was back in 1999) and it went bankrupt less than three years later.

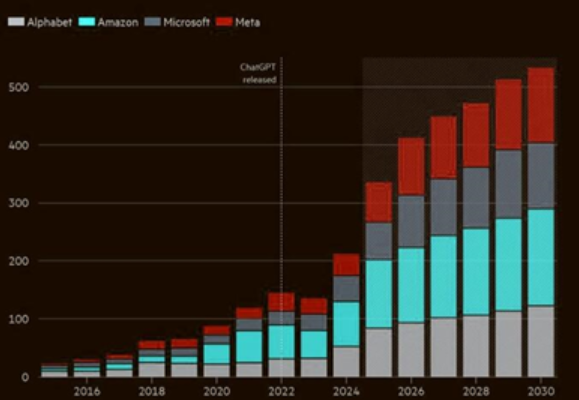

Those comparisons are being made today as companies spend feverishly to build out their AI-related products and services to gain scale fast. According to Visual Capitalist, the four largest AI spending companies will increase capex from $130B to over $500B in less than five years.

That’s a lot of added costs. What if there’s no benefit?

Well, I don’t suspect Meta, Amazon, Microsoft or Google will be going out of business like Global Crossing did. These companies are FAR too profitable whereas Global Crossing never made a penny of net profit in any given year of its existence.

However, valuations in the stock market today are better that the ‘benefit’ from this spending will start in earnest in 2026 and 2027 and carry forward for many years.

In the meantime, this spending by the ‘hyperscalers’ (A hyperscaler is a company that provides massive, scalable computing infrastructure and services—primarily cloud computing—capable of handling enormous workloads and rapidly adjusting capacity up or down) is causing a ripple effect into adjacent industries, boosting the stocks in other sectors like utilities (they will need to power the data centers), semiconductors (they are providing the chips in the servers among other products), data center infrastructure (networking, cooling, hardware builders like Dell and HPE), and software (MLOps platforms, cybersecurity, and AI middleware).

Sorry, getting technical. I digress….

The market is trading on the benefit of all this spending, that is supposedly coming. It will come since we are already seeing it but the question becomes, how much productivity benefit will we ultimately see, and when?

From a productivity perspective, companies remain in the early innings of AI adoption. Management commentary shows that many S&P 500 firms are starting to describe specific AI use cases in their businesses, with the largest share of companies discussing customer support/call centers (24%), coding and engineering (24%), and marketing (23%).1

Still, while some benefits are starting to be realized, we are in the very early stages of this transformational technological change. Think of this as 1994 or 1995 in terms of the technology rollout. The “winners” and “losers” of this transformation will not be known in 2025 or even 2026. It will take years for the industry to shakeout.

One winner that we know of today and that is at the center of the entire AI theme is a company called Nvidia. A decade ago, Nvidia made graphics chips for computers and other hardware primarily for gaming purposes. By 2020, they had shifted their business model to focus on cloud/AI adoption, and their original chips became the standard for large language models like Chat GPT making it the cornerstone of the AI trade and the most ‘picks and shovels’ of the AI gold rush.

It is now the most valuable public company EVER.

Compare this to 1999 when the internet transformation and the stocks related to it traded on the potential benefit to a shift online commerce. There was no revenue, let alone any profits. It was the Wild West and hundreds, if not thousands of startups all trying to take advantage. Today, there is far more fiscal prudence.

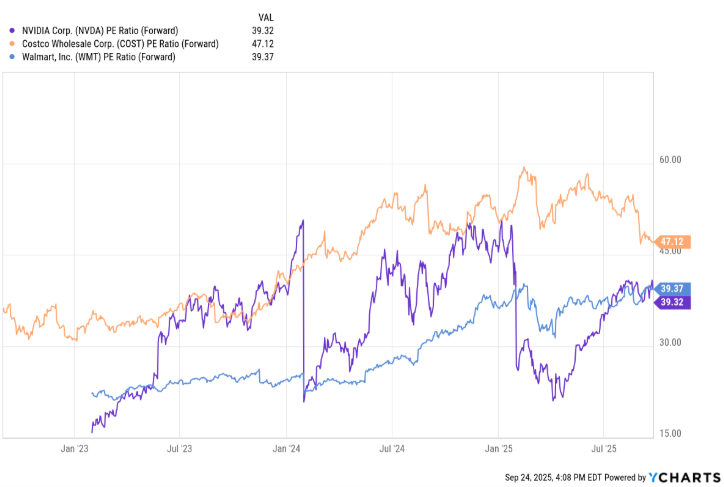

In terms of AI stocks, they are where most of the earnings growth is occurring. Let’s look at Nvidia, for example. If you invested in Nvidia in 2019, you would be up 5,200%. The stock is now trading at 39x forward twelve months’ earnings. Typically, that would be thought of as expensive.

However, if we compare Nvidia to Costco (COST) and Walmart (WMT), we can see that Costco is actually more expensive at 47x and Walmart about the same at 39x.

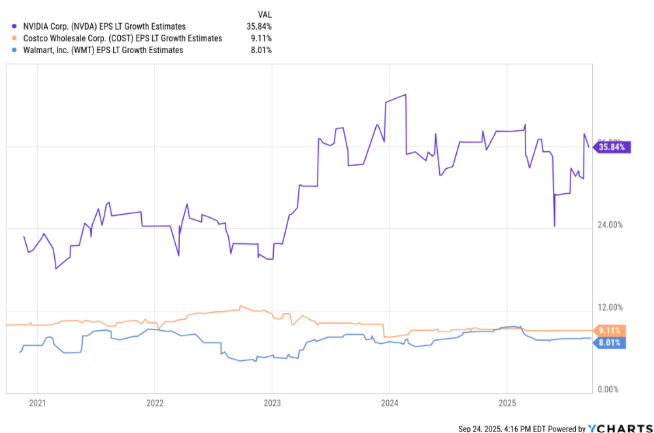

Remember, the valuation (the multiple of earnings paid) is a function of the future stream of earnings discounted back to today. A company growing earnings faster will be deemed worth more than one growing more slowly. Now let’s add in the next five years, earnings growth metric.

Here, it’s not even close. Nvidia is forecasted to grow at 36% per year for the next five years. That’s exceptional growth. To put that in perspective, if Nvidia earned $1.00 per share this year (they will earn much more than that but let’s make the numbers easy), by 2030, they will earn $4.48 at a 35% annual growth rate.

Meanwhile, Costco and Walmart, which trade at roughly the same valuation, are growing at 9% per year. If they earn $1.00 this year, they will earn $1.54 by 2030, a fraction of where Nvidia will be.

What would you rather own? A stock trading at 39x earnings growing at 9% or one growing at 36%? That is what the market is currently trading off of with the focus on this AI-related narrative.

In 1999, many of the companies that were soaring 100% in a month were gone by 2002. This market is extremely different in that the company’s soaring today are already big profit generators. The question is not if they will earn a profit but how fast they grow that profit benefiting from AI.

The valuation differential is also vastly different. In 1999, the Nasdaq Index was trading at more than 100x earnings, thanks primarily to so many companies making little to no money. Today, the Nasdaq is trading around 27x earnings, far below the dot-com mania.

There is still risk (isn’t there always?). The primary risk for the AI transformation is that monetization lags the hype. If that turns out to be the case, the earnings estimates will not pan out AND, at the same time, the multiples of those earnings at which those stocks trade will contract.

Perhaps the most significant difference between 2025 and 1999 is the nature of the technological revolution. While the dot-com boom was built largely on speculation about the internet’s potential, today's AI revolution is generating measurable productivity gains and revenue growth.

The question is more, how much?

For now, I would ignore the ‘mania’ calls and comparisons to 1999.

As always, we stand by to answer any questions you may have.

Sincerely,

Mark J Asaro, CFA

Noble Wealth Management