Client Memo: Why Do We Use Structured Notes and What Are Their Benefits?

Dec 10, 2025Most investors want the same thing: stock market upside without stomach-churning downside.

Structured notes are hybrid investments that combine market exposure with an options strategy to create a more controlled mix of risk and return than owning stocks outright. They can be an effective way for risk averse clients to stay invested in equities while defining, and often reducing, their downside risk over a specific time horizon.

Think of a structured note as a customized wrapper around market exposure: instead of owning the index “outright,” you own exposure with agreed-upon guardrails.

What is a Structured Note?

A structured note is a bit different than owning a fund of stocks. Typically, the notes are issued by a bank and link the performance to an underlying asset such as an equity index or even basket of stocks that we select. For instance, most of our notes are tied to the S&P 500 or Nasdaq. The options most often are used to protect any downside move in that index.

Maturities are usually fixed, commonly in the 1–5-year range, and investors are generally expected to hold to maturity for the strategy to work as intended.

In the end, you own a bond that has exposure to an equity index with a certain amount of downside protection. A typical setup we use for structured notes:

- 1–5-year note tied to the S&P or Nasdaq

- 100%+ participation, 20-30% hard protection.

These are point-to-point meaning we only care where they started and where they finished. Note that the 30% buffer kicks in based on the starting value, not on the highest value the note achieved during the period.

What that means is, over the term of the note (1-5 years), you will get at least what the S&P or Nasdaq does in terms of upside performance, and in many cases better, but if the index finishes down, we are protecting against the first 20% or 30% of those losses (i.e. “hard protection”).

With the gains achieved over the last few years, it makes sense to ‘lock some of those in’ and protect against a market decline. However, we never know when that decline will occur and, in theory, the market could run for many more years.

Example

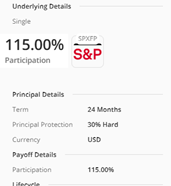

Take the note below:

In this note, the investor’s outcome is tied to the S&P 500 futures index for the next two years. If that index finishes up, the investor will get 115% of the return over that time period. If the index finishes that period down, the first 30% of losses are absorbed. For example, should the S&P finish down 35%, you are down 5%. If it were to finish down 20%, you’re down zero.

Benefits for risk averse equity investors

For clients who “want the upside without all the downside,” structured notes can help in several ways:

- Tailored risk/return: Notes can be engineered to match a client’s tolerance by adjusting protection level, maturity, and upside participation, effectively personalizing the equity exposure.

- Growth with a safety net: Buffered or capital protected notes seek participation in equity gains while limiting losses to scenarios where markets fall beyond the defined protection level.

- Smoother ride: Adding notes to a traditional stock/bond mix can reduce overall portfolio volatility while still maintaining meaningful equity linked return potential.

- Behavioral support: Knowing that part of the portfolio has explicit downside features can make nervous investors more willing to stay invested during turbulent markets, which supports long-term planning.

Key Risks

Since these are issued by a bank, we are taking the credit risk of that bank. If that bank were to fail, we would become creditors of that bank’s assets. This is why we only buy structured notes from only the best, most capitalized banks and diversify among them.

We also diversify among time periods. Since these are point-to-point, by diversifying that end date of the note, we reduce the risk that the note would be ‘in breach’ of that buffer. By spreading the maturity date, we can again reduce risks in the portfolio.

One of the things that I hear often from clients is, “why not put all our equities into structured notes?” The answer is because these are not exchange-traded and as a result selling, in some cases, can be difficult. We really want to use capital that is going to be untouched and committed to equities for one to five years.

Practical portfolio applications

In practice, as your financial advisor, we are replacing a portion of your traditional equity with growth-oriented notes to keep similar upside targets while lowering the impact of large drawdowns. For near retirees or conservative investors, principal protected or high buffer notes can serve as a bridge between pure fixed income and full risk equities, helping pursue growth without fully exposing capital to large market swings.

Ultimately, the goal is to achieve a 1:1 or better result on the upside and a less than 1:1 on the downside. For those more risk averse, we can likely achieve a 0.5:1 on the downside meaning that if the index falls by 10%, we would be down 5% or less in your equity allocation. But, if the index is up 10%, we would be up approximately 10% as well.

Best of both worlds.

With that education in place, structured notes can be positioned as a deliberate tool—not a gimmick—to align lower risk equity exposure with each client’s goals, timeline, and comfort with volatility.

As always, we appreciate the trust you place in us.

Sincerely,

Mark J. Asaro, CFA

Noble Wealth Management, PBC