Client Memo: 2026 Outlook - Preparing Portfolios Without Overreacting

Feb 03, 2026As we move into 2026, the most important objective is not making bold predictions—it is building portfolios that can endure a range of outcomes while still pursuing your long-term goals. As opposed to most firms, the framework we work with here is straightforward: avoid unnecessary knee-jerk reactions and stay disciplined through inevitable volatility, while keeping the portfolio aligned with your needs rather than headlines.

That said, we are seeing a confluence of events that should prove highly beneficial to risk markets. Many are using the ‘goldilocks’ term to describe this macro environment.

A Favorable Mix of Growth and Policy

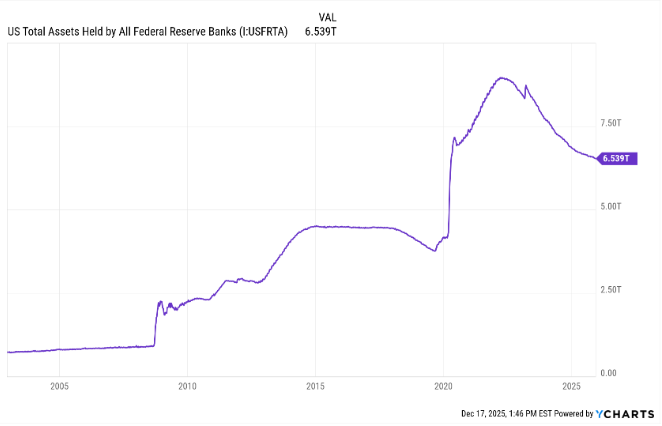

We have the Federal Reserve in easing mode. Not only did they cut rates by 75 bps in 2025, but they also ended the quantitative tightening (“QT”) of the balance sheet. QT was the reduction of the holdings on the Fed’s books.

At its peak, the balance sheet had nearly $9T of assets. Today, it is down to $6.54T, a sizable reduction and one of the few times in the Federal Reserve's history that they reduce holdings.

We are also slated to get a new Fed chairman in May. The likelihood is that the new head of the Fed will be more open to reducing rates.

What does this mean?

Essentially, this should help reduce rates, especially in the middle and longer end of the curve as it should ease financial conditions modestly. While there will be headline risk surrounding Fed leadership changes and shifting rate expectations, these factors tend to matter less over time. The Fed will be a big tailwind in 2026 and the old mantra, “don’t fight the Fed” will be in focus.

Fiscal Policy as a Structural Force

The One Big Beautiful Bill (“OBBB”) passed early last year will provide significant stimulus to the economy. The primary benefit being to make permanent the tax cuts from 2017 as well as further reductions in tax rates for those making under $50,000.

It also allows for full expensing for new factories and improvements built in the U.S. That accelerated depreciation should dramatically increase capital expenditures by corporations, providing an economic boost.

Fiscal dominance is a new theme that shouldn’t be fought. It is no longer a thesis but the new reference point. It is now a structural construct and no longer cyclical. With the reset of fiscal spending higher (largely since 2020) and paired with the monetary policy from the Fed being unrestrictive, it creates a floor for nominal GDP growth as well as corporate earnings.

While many of us want the Federal government to institute fiscal restraint, that paradigm is now gone and has been for almost a decade. This means that the debasement trade remains intact almost requiring an investment in precious metals, hard assets, and perhaps bitcoin as well.

Inflation: Moderating, Not Disappearing

Inflation is set to moderate, especially in the back half of next year. We have oil approaching five-year lows, and the price of oil tends to lead inflation by a few months. Additionally, housing has been rolling over and will be a drag on inflation in 2026.

The changes of inflation hitting the Fed’s target of 2.0% is unlikely in 2026, or even 2027. There is just too much liquidity out there searching for a home. That liquidity is a function of fiscal spending (mentioned above) and monetary stimulus (also mentioned above) preventing prices from rising much slower.

This is a new regime of higher prices that is unlikely to change until we see a meaningful slowdown in nominal GDP growth.

The Broadening of the AI Cycle

The AI boom appears to be broadening beyond the handful of players that have led it so far. AI is now a genuine macro driver, not just a tech-sector story.

Think of the dot-com boom in the 90s but likely more profound for the future. Even the railroads of the late 19th century are a good parallel. These generationally transformative technologies typically follow a similar path: skepticism, rapid adoption, market exuberance, and an adjustment of expectations.

The key here is that while the technology and the industry as a whole is very much real, the winners and losers have not yet been established. Profits and productivity benefits have yet to fully materialize, and we remain in the very early stages of this transformation.

The early winners have been the Magnificent 7. These are the early adopters- akin to the first miners in the California Gold Rush. But as happened during the gold rush, the winners broadened from a handful to many. The ‘picks and shovels’ of the gold rush started to see huge profits.

That has started to occur since late 2025 with the concentration of the S&P 500 peaking and the bull market broadening out. In 2025, the S&P already saw less dominance from the Mag7 and the first time in three years, where they didn’t contribute more to the S&P 500’s return than the other 493 stocks in the index.

- S&P 500: +17.9%

- Mag7: +7.5%

- Other 493: +10.4%

We think that continues as the picks and shovels companies get identified and exploited. The amount of capital expenditures committed to the US AI-trade is now greater than the Apollo Project, Interstate High System Project, and the Manhattan Project, combined. This is now known. The risk for the Mag7 is to the downside if expectations for significant earnings growth do not come in. This is why we are de-emphasizing that trade – US large cap growth stocks – in favor of cheaper areas of the market that are not priced for perfection.

What does this mean for portfolios?

It means that the S&P 500 is unlikely to be the leader of indices again. As the markets and gains broaden to smaller, value-oriented, and international names, the contribution from a diversified portfolio will be more meaningful.

It doesn’t mean we won’t hold US large cap, but it does mean we will reduce the weight in our baseline models to it, in favor of US midcaps and small caps, as well as international stocks (both developed and emerging markets).

Headline volatility appears to be on the increase. Those, to us, are great buying opportunities as the historical data shows.

We continue to move towards a risk-managed approach investing where the risk-return setup looks great and adding downside protection on top of it. This top-down approach appears to be working well and will really show itself during down moves in the market.

We continue to shift portfolios towards three areas and away from two:

- Increasing international exposure. This is not a reflection of ‘the end to American exceptionalism’ more than it is a manifestation of the differences in valuation between US stocks and foreign ones, as well as the US dollar overvaluation.

- Increasing small and midcap exposure. While US large caps are richly valued thanks to the AI -theme, US small and midcaps remain fairly cheap not having participated in the rally since late 2022.

- Precious metals. Gold, silver, palladium and platinum remain core pieces of our portfolio in various formats including the physical.

- In bonds, an emphasis on closed-end funds. Bonds will transition from a diversifier to a source of risk as credit spreads remain very tight. We continue to find more niche opportunities in closed-end funds and other areas to reduce our risk profile and increase returns.

Concluding Thoughts

2026 is likely to be a year where risk and opportunity coexist: uneven global policy, evolving inflation dynamics, AI-driven investment and productivity potential, and periodic volatility spikes. Our job is to keep your portfolio aligned with what you’re trying to accomplish—growth where you need it, income where you rely on it, and risk controls that allow you to stay invested through the full market cycle.

As always, we remain committed to helping you achieve your goals while reducing risk. If you have any questions, please feel free to contact anyone on the team.

Sincerely,

Mark J Asaro, CFA

Noble Wealth Management