Client Memo: 2025 in Review | Markets Advanced, the Economy Zoomed, and Diversification Was Rewarded

Jan 15, 2026From an investment perspective, 2025 was a constructive year, even if it didn’t always feel that way in real time. Markets absorbed shifting expectations for inflation and interest rates, policy uncertainty, and periodic risk-off episodes, yet ended the year with broad gains across equities and a welcome recovery in high-quality fixed income. The word of the year would aptly be called, ‘resilience.’

Market Results: Strong equity gains and a meaningful rebound for core bonds

U.S. stocks finished 2025 with double-digit gains across the major indexes for the third year in a row. The S&P 500 Total return was 16.4% and the Nasdaq Composite rose 20.36% for the year. These gains extended a multi-year upswing, with leadership again skewing toward growth and technology-related themes, including continued optimism around artificial intelligence.

As we wrote last year, we anticipated smaller companies to start participating- and they have. The Russell 2000 gained 12.8% in 2025, which is notable given how uneven small-cap performance had been in prior years. While small caps did not outperform large caps, they delivered solid absolute returns and reinforced the value of maintaining diversified equity exposure beyond the very largest companies. Additionally, they outperformed large caps in the last six months of the year and have continued momentum to start 2026.

International markets were strongly aided by the falling dollar, which was something we also anticipated. Broader developed markets outside the U.S. performed well with the MSCI EAFE Index (developed markets ex-USA) returning 31.89% in 2025. Emerging markets did the best with the MSCI Emerging Markets Index up 30.94%.

Fixed income finally contributed again in a way many investors recognize from the pre-Covid times- it was again a stabilizer and a source of return. The Bloomberg U.S. Aggregate Bond Index returned +7.3% for the year. High-quality bond exposure provided meaningful positive returns for the first time in years, improving the performance for balanced portfolios.

The Economy: the K-Shaped Divide Persists

On the economic side, 2025 can be summarized as “resilient.” GDP increased at an annual rate of 4.3% in Q3 2025 (initial estimate), reflecting strength in consumer spending, exports, and government spending, partly offset by a decline in investment. GDP growth likely moderated into year-end and tracking in the high-2% area; we’ll get the Q4 2025 advance GDP report on February 20

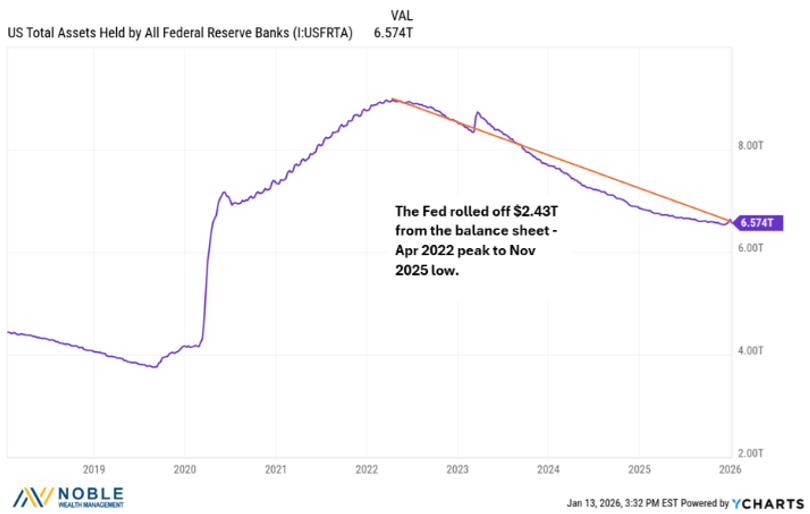

We saw a shift in monetary policy that was largely expected. The Federal Reserve cut rates three times last year, bringing the target range for the federal funds rate from 4.25%–4.50% earlier in 2025 to 3.50%–3.75% by year-end. Also, as important but maybe not as understood was the switch from quantitative tightening (‘QT’) to quantitative easing (‘QE’) of the balance sheet. This is an important tailwind factor going into 2026. As you can see below, the amount of securities owned by the Fed contracted from almost $9T to $6.57T. It will now start expanding again.

Inflation continued its gradual downtrend, though the path was not perfectly smooth. The Consumer Price Index (“CPI”) increased 2.6% over 2025.

The labor market softened but did not appear to break. It remained resilient. The unemployment rate finished the year at 4.4%, higher than the prior November’s 4.2%, but still within a range historically associated with continued economic expansion. This combination—moderating inflation and a slightly softer labor market—is precisely the environment that made the Fed more comfortable shifting toward rate cuts.

Practical portfolio implications from 2025

- Diversification worked better than concentration. Whether one owned U.S. large caps, small caps, developed international, emerging markets, and high-quality fixed income, 2025 reinforced that diversified exposure can participate in upside without relying on a single theme to be “right.”

- Fixed income regained strategic value. With policy rates lower than earlier in the year and yields still positive, bonds provided both income and price appreciation. That improves the “math” of prudent retirement and income planning, because portfolios do not need to take as much equity risk to pursue a reasonable return target when high-quality bonds are contributing.

- Short-term narratives remained noisy, but long-term discipline was rewarded. Reuters’ year-end wrap highlights how markets navigated policy uncertainty and still finished with strong annual gains. The lesson is not that risk disappears; it is that investors are usually better served by maintaining a plan, rebalancing when appropriate, and keeping risk aligned with their personal objectives.

Closing perspective

As we close out 2025 and shift into the new year, we continue to monitor the path of monetary policy, the Supreme Court’s decision on tariffs, labor market softness, and consumer durability. Perhaps most importantly, we are cognizant of concerns around an AI bubble, the timing of AI productivity payback, as well as the crowded bullish consensus on the sell side.

We expect earnings growth to maintain its steady footing throughout 2026, based on a variety of factors: A possible reversal of tariff headwinds, significant fiscal stimulus, lower interest rates, a potential bounce-back of the middle-class consumer, and AI—assuming further productivity gains are realized.

From a portfolio construction perspective, the low correlation between stocks and bonds is returning to historical norms, meaning a diversified stock/bond portfolio is coming back, creating a very favorable dynamic from a risk standpoint. For long-term investors, this is a good opportunity to rebalance, diversify, and focus on fundamentals.

As always, we’re here to answer any questions. Please be on the lookout for our Outlook 2026 memo, which will follow shortly.

Sincerely,

Mark J. Asaro, CFA

Noble Wealth Management