Bonds Tend to Shine Following Last Fed Rate Hike

Nov 03, 2023The Fed kept rates at current levels at their meeting this week, but whether they are done with their tightening or not is yet to be determined. If there is one more hike (or even two), it doesn’t really matter at this point.

Monetary policy is now extremely restrictive and while it takes time for that to filter through to the underlying economy, we are already starting to see the effects. There is a significant lag effect between the time when the Fed raises rates and a slowing of economic growth.

Fed's Rate Hikes: Consumers Feel the Strain as Economic and Inflationary Impacts Unfold

At the press conference, Federal Reserve Chair Jay Powell noted higher rates on everything from mortgages to corporate borrowing will have an impact on activity moving forward. Secondly, he stated the Fed thinks the full effects of policy actions to-date have yet to be fully felt.

Consumers are starting to feel the pinch. We are seeing rising interest expense and delinquencies on everything from auto loans, home mortgages, and credit card balances.

I think it is only a matter of time before we start seeing job losses.

The Fed has gained some traction against inflation with core inflation now at +3.7%1, down significantly from last year. But the Fed is fighting against the fiscal side – congress – which continues to spend like drunken sailors. In fact, it is now estimated that we will have a $2 trillion deficit this year, 8% of GDP, something that has never occurred outside of WWII. Not even during the Financial Crisis of 2008 did we see such deficit spending.

I do think this will be the next crisis as interest expense on US debt is set to skyrocket but that’s for another memo. However, I do not expect rates to stay elevated forever. Sometime in the next year, the Fed will begin “rightsizing” rates towards neutral as inflation continues to move lower.

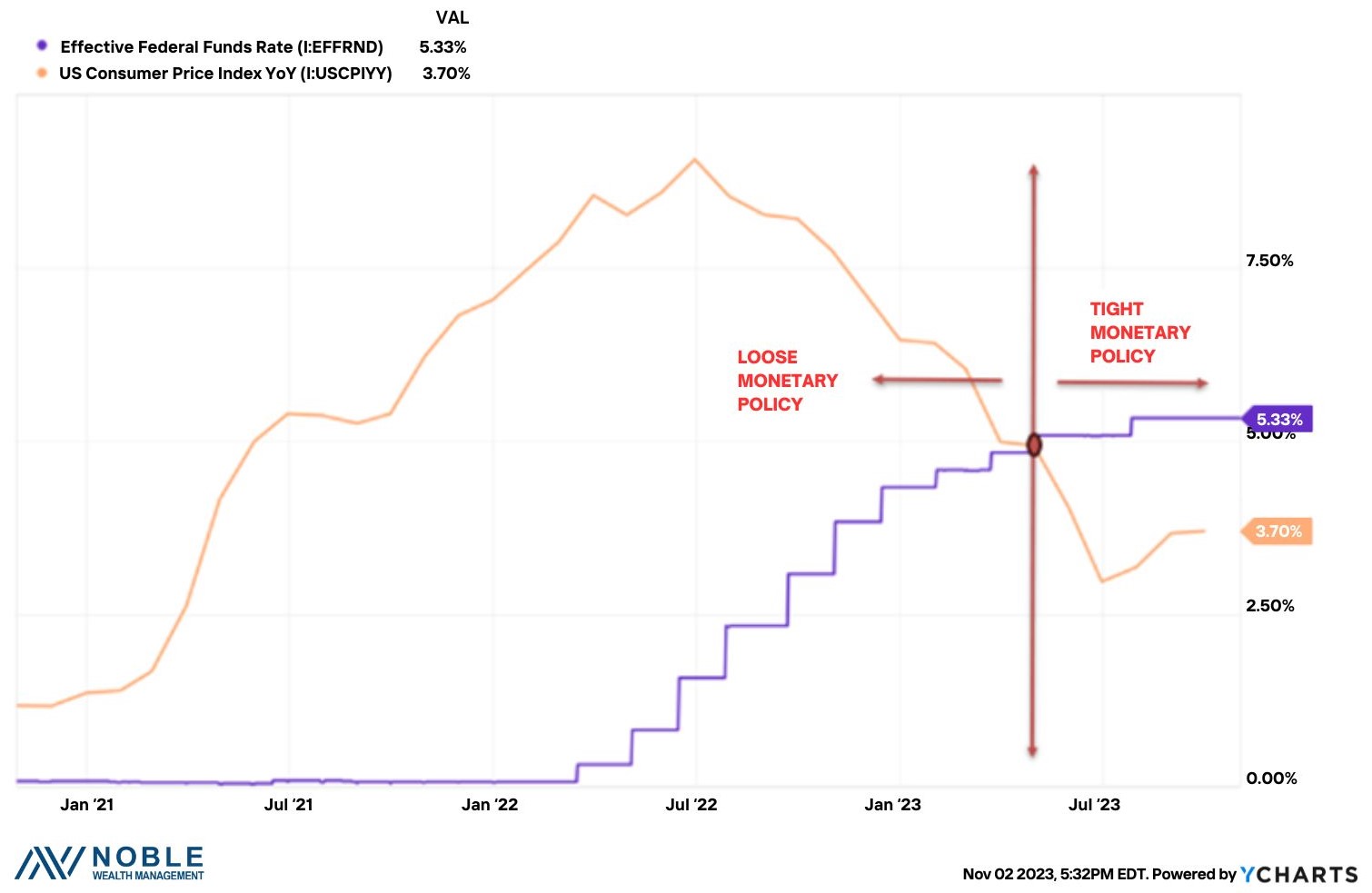

The Federal Reserve has raised rates at an unprecedented pace in the last 18 months but they were playing catch up for the first twelve months. Policy only began becoming ‘tight’ in the last six months (see chart below).

Source: YCharts, as of 11/02/2023. Graph illustrating percent change over time.

Restrictive Rates and Their Impact on Bond Investment Strategy

The Fed meeting on November 1st was boring, which is a good thing. They are in ‘wait and see’ mode now with policy. They made a significant move in a short period of time and are now waiting to see the impact on the economy.

There is a substantial lag between a rate hike and the effect on both businesses and consumers. Apollo Global’s Chief Investment Office Torsten Slok recently stated that the drag on growth takes 12 to 18 months to fully take effect.2 That means we are just starting to see the consequences of the first couple of rate hikes that occurred in March 2022.

This is why we still think a hard landing, a la’ recession, remains the base case outcome from all of this. It is also why I think the Fed is likely done raising rates.

Real rates (interest rates minus inflation) are now decidedly positive and highly restrictive. It is only a matter of time before that is felt more significantly by corporations and consumers alike.

This has important implications for our bond investments. We are currently locking in higher interest rates with high-quality, long-term corporate bonds.

While that has hurt a bit recently as rates continued to move higher, we think over the next several years these will turn out to be great investments as interest rates move lower.

In part II of this memo, I will detail a bit more closely about the portfolio implications. In the near future, we will also conduct a zoom call with clients to answer any questions they may have.

As always, we value the trust you place in us.

Mark J Asaro, CFA

Noble Wealth Management PBC

2. https://apolloacademy.com/the-monetary-policy-transmission-mechanism-takes-12-to-18-months/