While Bond Prices are Down; Feds Higher for Longer

Sep 04, 2023“The daily blips of the market are, in fact, noise -- noise that is very difficult for most investors to tune out.”

– Seth Klarman

Summary

Interest rates are moving higher thanks to a combination of massive fiscal deficits, foreign owners of our debt selling, and a continued strong US economy. At some point, rates will be high enough to entice more investors to buy US debt causing weakness in other markets, namely equities. And the supply and demand balance will be restored.

If there is enough weakness in equities, you will see a flight to safety moving from risky assets (like stocks) to buy higher yielding treasuries.

Investors will think, “why own a volatile stock to potentially earn 8% when I can get 5%+ in a risk-free US government bond?”

Fed Signals Higher Rates Ahead: Impact on Markets and Bonds

The Federal Open Market Committee, the group of economists that set interest rate policy at the Federal Reserve, met last week and left rates unchanged. However, in their updated “dot plot”, their expectations for where rates will end up went moderately higher.

The market is finally beginning to believe the Fed that rates will stay higher for longer. Current Fed Funds sit in a range between 5.25% and 5.50%, a 22-year high. Fed Chair Jay Powell stated that he was prepared to continue to raise rates if inflation didn’t come down closer to the Fed’s target of 2.0%.

The Fed, however, only controls the short end of the yield curve, the overnight rate that banks charge each other on excess reserves. The rest of the yield curve is market-driven. Bonds prices move inversely with interest rates. Remember that see-saw picture in my memo earlier this year?! Rates up, bond prices down. Rates down, bond prices up.1

Source: Integrated Life and Financial Planning, United States Fed Funds Rate. Illustrating relationship between prices and interest rates.

Why Not Wait? Bond Prices, Rates, and the Pull to Par

“Mark, why not just buy bonds when the Federal Reserve is done raising rates? That way, our bond positions don’t lose value.”

I have received some variation of the above question over the last several months. As interest rates have risen, bond prices have inched lower. To be sure, a loss on a position is never fun. However, two things to keep perspective.

1. Bond prices will converge on par as they approach maturity. So any losses will only be temporary.

2. Interest rates are expected to decline – even by the Fed’s own forecast – starting next year which should easily erase any losses.

The pull to par is a powerful force. That is, the gravitational force of the price of a bond to approach par ($100) as it closes in on maturity. Unlike stocks, I can tell you how much each individual bond we purchase on your behalf will earn over its life, so long as there is no default.

What I can’t tell you is the path to get there. If the yield to maturity is 6.5%, it won’t be a linear trip. In other words, it won’t be 6.5% every year but at maturity we know that the annualized rate will be 6.5%. The beauty of individual bonds is that we know interest rate changes affecting the market value of the bonds are only temporary.

There are several reasons why we are seeing interest rates rise. The US economy has continued to perform well, and the labor market seems impermeable to higher rates. Recession forecasts have melted away or been pushed out towards 2025. This means the Federal Reserve will need to keep interest rates higher for longer in order to slow the economy down.

Additionally, the U.S. government is expected to run meaningful deficits over the next decade, which means the Treasury department is going to have to issue a lot of Treasury bonds to cover those deficits at the same time the largest owners of Treasury securities are reducing their holdings (China and Japan have been selling their US treasury holdings to finance their economies).

For the last two years, the Fed has been tightening monetary policy. However, the fiscal side of the government (Congress) has been negating all that work through profligate spending. In fiscal 2024 (started Oct 1, 2023), the US is expected to run a deficit of $1.8 trillion. That is up from $1.6 trillion last year and $1.4 trillion in fiscal 2022.2

As of the end of September, total US debt hit $33 trillion. To be fair though, only $26 trillion is held by the public (with the rest held in various parts of the US government). That total debt is expected to grow to $46 trillion in the next ten years.3

That is a lot of additional capital needed to fund the government. The question is, who is the buyer of all this incremental debt?

This is the supply and demand that is likely causing investors to demand additional compensation for owning longer maturity treasuries, pushing up rates.

How high can rates go?

Obviously, this is the million-dollar question.

The balance between demand for treasuries and the growing supply is a natural balance that is hard to forecast. With much of the treasury curve yielding more than 4.75%, a lot of households are buying bonds to generate decent returns with less risk.

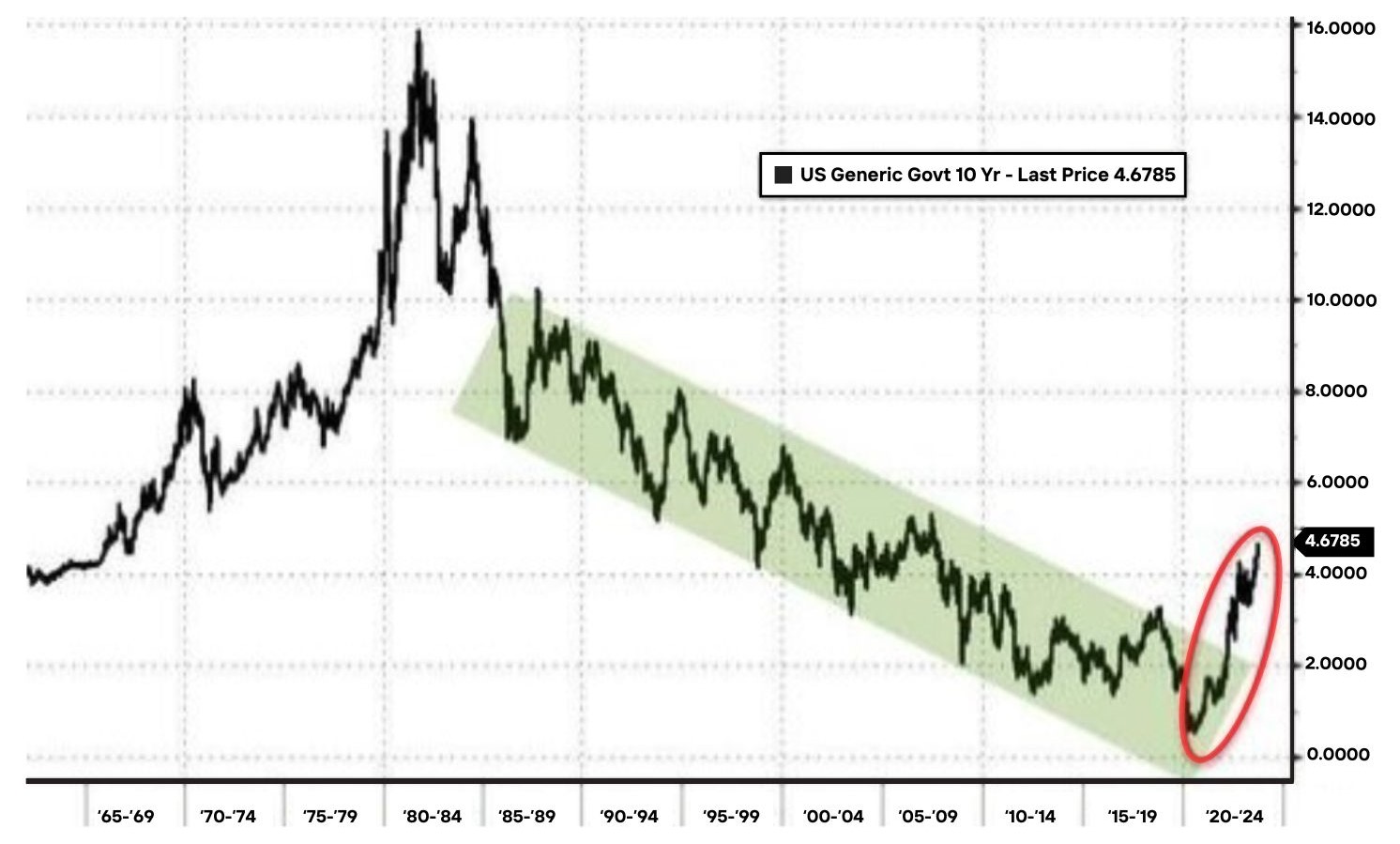

The chart below shows the downward trend in rates for most of the last several decades. That trend broke shortly after Covid as the government through nearly $7 trillion into the economy.4 We now have the ramifications of that policy with higher inflation and massive deficits.

Source: ZeroHedge, data as of 10/04/2023. Graph Illustrates US Generic 10 year Treasury Yield.

It is conceivable that rates go meaningfully higher. But we are nearing a breaking point where treasuries are draining a lot of liquidity from other markets. Supply and demand will eventually balance, and rates will stabilize.

Once that occurs, momentum will shift back, and incremental buys will step in.

What are we doing?

Currently, we think bonds are the better bet than stocks. We will be releasing a video to clients going through our thoughts on the markets and positioning for the next year. This is something I plan on doing quarterly.

Client portfolios in bonds are split between long and short maturities- what is called a barbell strategy. Think of the long maturities as us ‘locking in’ current rates. We may not pick the top in rates, but we’ve taken a measured approach, averaging in.

The objective here is to hold to maturity. So long as a bond doesn’t default, you get back your initial investment, plus any appreciation in the bond price plus accrued interest. As we detailed above, any minor losses will be erased.

We have also positioned portfolios defensively. Not just defensively but very defensively. Cash and short-term investments are prominent in client portfolios. That is dry powder for when either market corrects.

What should you do?

Nothing. This is something we anticipated which is why we used a barbell approach. Patience and fortitude are the two traits that make the best investors.

As always, we are here to answer your questions and appreciate your trust in us.

Sincerely,

Mark J Asaro, CFA

1. https://ilafp.com/financial/looking-for-alternative-to-your-bond-holdings/

2. CBO: Budget and Economic Outlook 2023- 2033 https://www.cbo.gov/publication/58946

3. https://www.cbo.gov/publication/58946

4. https://www.nytimes.com/interactive/2022/03/11/us/how-covid-stimulus-money-was-spent.html